Being involved in a car accident can be a stressful and overwhelming experience, especially on Pennsylvania’s busy roads. Knowing the right steps to take immediately after an accident can protect your safety, preserve your legal rights, and ensure a smoother recovery process. In this guide, we’ll walk you through the essential actions to take after a car accident in PA, from ensuring everyone’s safety to documenting the incident and understanding your legal rights.

What to Do After a Car Accident?

Whether your car accident is minor or catastrophic, an accident occurred and damage has been done to your vehicle and you could be injured. Therefore, it is important to treat minor accidents the same as you would treat a “big accident”. If you’re involved in an accident we recommend following the steps below to ensure a solid case.

Things To Do After A Car Accident

Using your phone or a notepad, record the following information.

- Exactly where the accident took place

- The position of the vehicles before and after the accident

- Photographs of signs, buildings, or other obstructions that may have been involved in the cause of the accident

- The names and addresses of anyone who was involved in the accident (passengers and drivers).

- The names and addresses of anyone who witnessed the accident.

- The make, model, and license plate information for all vehicles in the accident.

- The insurance information for all vehicles involved in the accident.

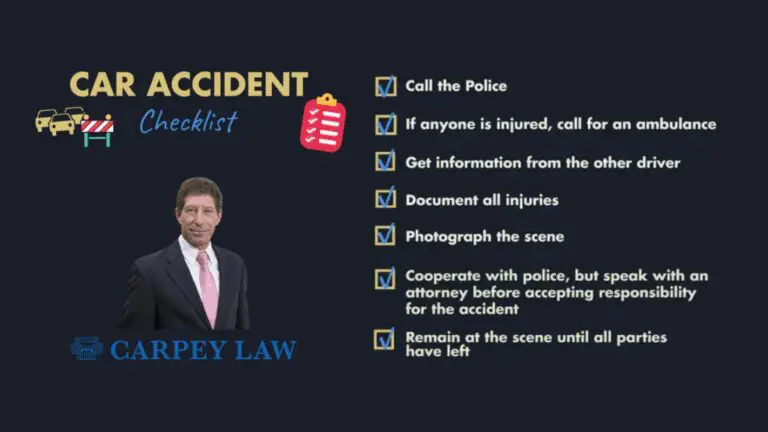

Here is the Complete Car Accident Checklist:

- Call the Police. Immediately inform the police after the accident, even if it is minor, and file a report. If possible, wait until the police arrive at the scene or, talk to the police via phone about the accident as soon as possible.

- Call for an ambulance. If you, your co-passengers, or anyone at the accident scene is injured, call for emergency medical assistance.

- Get information from the other driver. It is very important for you to collect information from the other driver and other passengers including their contact numbers, names, addresses, etc. It is also critical to note the license plate number and state..Get the contact details of any witnesses that are present at the scene as well.

- Document all injuries. Oftentimes, major injuries are not recognizable immediately after an accident. However, it is very important to make a list of all big or small injuries and pains you and other passengers are experiencing.

- Photograph the scene. Capture photographs and videos of the accident spot from multiple angles.

- Pictures of the damaged car

- Pictures of the injures that you and other passengers suffered

- Tire or skid marks on the road

- Pictures of the road, highway or intersection point where the accident happened

- Pictures of the traffic lights or stop signs on that road.

- Cooperate with police, but speak with an attorney before accepting responsibility for the accident. Do not speak with anyone about the accident other than the police. You do not have any obligation to accept responsibility for the accident or blame others for the accident.

- Do not leave the scene of the accident. It is important for you to remain at the accident location until everyone involved, including the police, have left the scene or you are transported for emergency medical assistance.

Who pays medical bills after a car accident?

The person that caused my injuries pays for my medical bills, right? Well, that makes sense, but in personal injury cases, that’s not what happens. In Pennsylvania car accident cases (and all other kinds of “vehicular accidents” like bus accidents, truck accidents, and pedestrian accidents), your own insurance pays your medical bills.

After any kind of vehicular accident, you’ll need to give the doctor or the hospital both your auto insurance information and your health insurance information. Under Pennsylvania laws, particularly 75 PA C.S.A. Section 1797, the medical provider is required to submit the bills to whatever insurance you have. Auto insurance is primary in any kind of vehicular accident, and health insurance is secondary. That means once your auto insurance carrier “exhausts” or pays out the maximum amount of medical coverage you purchased on your auto policy (usually $5,000), your health insurance will then be billed moving forward for any additional treatment related to your Pennsylvania car accident.

What if you’ve been involved in a car accident and you have medical bills, which you’ve submitted to your auto insurance carrier? However, your auto insurance company refuses to make payments on those medical bills. You may need a car accident lawyer in PA to file a lawsuit against your auto insurance company in this situation. Watch this video to get more insights about “What Happens If My Car Insurance Won’t Pay My Medical Bills After An Accident?”

How Long After a Car Accident Do You Feel Pain?

Pain after a car accident can appear immediately or be delayed for hours, days, or even weeks. This is because adrenaline released during the accident can mask pain initially. Even minor accidents can cause delayed pain as injuries may not be immediately apparent.

It’s crucial to seek medical attention promptly, even if you feel fine initially. This allows for proper diagnosis and treatment, which can significantly impact your recovery.

When to See a Doctor for Whiplash?

You should consult a doctor promptly after a car accident if you experience any of the following: neck pain, headaches, shoulder pain or stiffness, or low back pain. Early medical attention is crucial for diagnosing whiplash and initiating appropriate treatment, which can help prevent long-term complications.

Should You Call an Insurance Company After an Accident?

You are not under an obligation to contact your insurance company immediately; in other words you are not obligated to contact your insurance company from the scene, or from the hospital or even within the first day or two after the accident. Typically an insurance policy requires that you give them notice of the accident as soon as possible after the accident. The insurance company does not necessarily have your best interest in mind. They have their own best interest in mind. For this reason, it is always a good idea to contact an attorney following a car accident in order to help you deal with the payment of medical bills, resolution of the property damage, and basically to deal with all issues concerning your case, and in particular issues involving your insurance company and the other driver’s insurance company. For more information about auto insurance, review the Pennsylvania Auto Insurance Guide.

Why Do Insurance Companies Delay Settlements?

Insurance companies often prioritize profit over fair compensation for policyholders. This can manifest in various ways, including delaying or denying legitimate claims, utilizing software to minimize payouts, and employing a “deny, delay, defend” strategy. These tactics aim to force claimants to accept low settlements or discourage them from pursuing legal action.

To effectively navigate the insurance claims process, it’s crucial for individuals to be aware of these tactics and understand their rights. Seeking guidance from an experienced attorney can be invaluable in ensuring fair compensation and protecting your interests when dealing with insurance companies.

How to Deal with the Insurance Company After an Accident?

The following is an important guide to avoiding the common tricks that insurance companies employ to try to get out of compensating you for the injuries and damages you’re owed. You should follow these steps to the best of your abilities:

- Don’t take their calls: Despite what the insurance company tells you, you are not required to call them immediately as they will want you to submit a recorded statement. Convincing you to give a recorded statement directly following your accident is a tactic insurers use to try and poke holes in your version of events and injury claims. You are not obliged to do this as it will only advantage them.

- Don’t say anything: Before contacting your attorney, don’t say or comment anything to anyone that can damage your case. Because some general comments of yours like “I am okay“ can be used against you.

- Don’t settle for anything: The first offer the insurance company makes is often a low ball settlement that they hope you will blindly accept without consulting an attorney. To accept this initial settlement is to forfeit any extra money you may be entitled to. Do not agree to an early settlement without first speaking with a qualified Pennsylvania personal injury attorney.

- Don’t sign anything: You may be asked to sign a release so the insurance company can get your medical records, and your employment records. You are under no obligation to provide the adjuster with a release for your records. Remember, the adjuster works for the insurance company. His or her goal is to minimize your injuries, and to deflect as much responsibility for the accident and your injuries away from their insured. Having a release helps the adjuster to obtain, for instance, medical records that have nothing to do with your injuries from the accident and therefore to claim that your injuries are not as severe as you say they are and were perhaps not caused by the accident.

- Discuss with your attorney before signing: Insurance companies are not opposed to watching you. They may have some form of surveillance on you as you go about your day, hoping to use their findings against you. Your insurance company may need your sign so that they can pay your medical bills but you must contact your attorney before signing anything.

- Contact Carpey Law: If you’ve been in an accident and want to pursue a liability case, you should read the above bullets carefully, and most importantly, you should speak with an experienced personal injury attorney who can offer you even more insight into what to expect in your personal injury case. And for even more information, please see the other articles in our car accident law articles section. Or Contact us for any help.

For more details on handling insurance claims, visit the Pennsylvania Insurance Department’s Auto Insurance Page.

Will the other driver’s insurance cover the cost of car repairs?

It is possible that the other driver’s insurance company will offer to pay for the damage, but that’s not always the case. Typically if there is a dispute over liability, ie. who caused the accident, the other insurance company will not pay for the property damage.

If you have purchased “collision coverage” from your own insurance provider in Pennsylvania then you can turn to your insurer to help cover some of the damages. In fact, it is entirely possible that your own insurance company will offer you better service than the other driver’s. As long as the repairs to the car do not add up to more than the value of the car pre-accident, the insurance company should cover the cost. But that’s not all.

What is the diminution in value Claim?

It is important to remember that in Pennsylvania the insurance company should not only pay you for repairs to the car but also for the car’s diminution in value. After an accident, your car will be less valuable than it was before the accident. A car that has undergone repairs will never be as valuable as a one which never needed repairs. This loss in value is known as diminution in value. Unfortunately, proving diminution in value is a difficult task. Obtaining an affidavit from your repair shop might prove useful.

What happens with Insurance when your Car is totaled?

After a mechanic assesses the damage to your car and decides how much it will cost to repair it, your insurance company will decide if it is cost efficient to pay for those repairs. If the cost of repairing your car is more than 80 per cent of the blue book value of the car they may decide to total the car in Pennsylvania. What happens next is that your insurer will pay you approximately the amount of money you would have received for the car the day before the accident occurred, i.e. the book value. Your insurance company may not necessarily offer a number that you think is fair. Sometimes an affidavit from the mechanic can be helpful. In all cases, the process can be made simpler if you seek the assistance of a skilled attorney. Without an attorney, you may wonder if you are being taken advantage of.

How long after a Car Accident can you Claim an Injury?

In Pennsylvania, you have two years to file a claim after a car accident. This is called the statute of limitations which provides a certain time period in which you can bring a certain legal claim, but bars the same claim from being made after the time period has run. This is to protect plaintiffs and defendants alike. This allows plaintiff’s an adequate amount of time to file suit, but also grants potential defendants the ability to not be on the hook for the rest of their lives.

Read more about How long after a Car Accident can you Claim an Injury

What is the Average Settlement for Injuries from a Car Accident?

There is no perfect formula for predicting the amount of money in a car accident settlement. It is affected by a number of factors, including the extent of the injury, the amount of time spent treating, the amount of property damage, the amount of medical bills and whether or not the injury has any permanent side effects, whether there has been surgery or other invasive procedures, and wage loss or time missed from work. While there is no average, because of the variety of factors that go into valuing personal injury cases, these kinds of cases can result in very high settlements and verdicts.

Are You Still Worried On What To Do After A Car Accident?

Feel free to share this checklist with others, print, and store in your glove box for quick access at the accident scene. Call our law firm’s toll-free number 610-834-6030 if you have any questions about your unique circumstances concerning an automobile accident.

Contact Stuart Carpey and the Carpey Law team today!

Stuart A. Carpey, who has been practicing as an attorney since 1987, focuses his practice on complex civil litigation which includes representing injured individuals in a vast array of personal injury cases.